The Importance of Having Car Insurance Coverage

Car insurance is one of the essential things that every car owner should have. When buying a car, it is crucial to purchase an insurance policy that will cover you and your car in the event of an accident. Having car insurance coverage is not only a wise financial decision but also a legal requirement in most states in the United States.

Car accidents can happen to anyone at any time, and no one can predict when such a situation will arise. Some drivers might argue that they are careful drivers and will never cause an accident, which might be true for a while. Still, statistics indicate that even the most experienced and cautious drivers can cause accidents due to unavoidable circumstances. When you cause an accident, the damages and expenses that come with it can be significant, and without insurance coverage, you might end up paying for it from your pocket.

Having car insurance coverage is important because it protects you financially. If you get into an accident, the insurance company will take care of the damages and expenses that you might incur. Once you report the accident to the insurance company, they will send an adjuster to assess the damages and determine the cost of repairs. In case the car is beyond repair, the insurance company will compensate you the current market value of the car. This way, you are assured that you will not have to dig deep into your pockets to fix the damage done.

In most states, it is illegal to drive without insurance, and if you are caught without an insurance policy, you might end up facing legal consequences, such as hefty fines, license suspension, and even jail time in some extreme cases. Additionally, driving without insurance coverage means that you are putting yourself and other road users at risk. If you cause an accident and do not have insurance coverage, you might not be able to compensate the other party for the damages you caused.

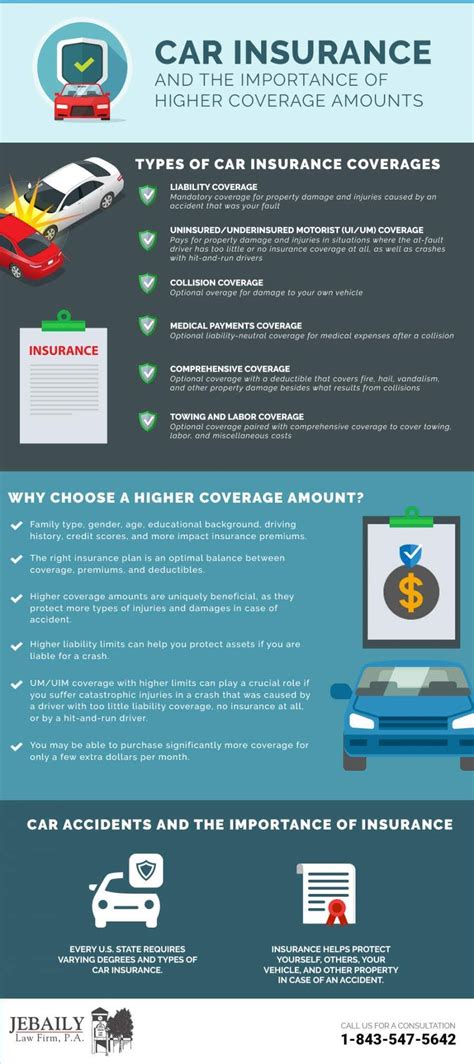

Insurance policies come in various forms and coverages, depending on the company and the premium you pay. Some policies might only cover damages caused to the other party, while others might cover both parties and the car itself. It is essential to understand your insurance policy and the extent of its coverage to ensure that you are adequately protected. Furthermore, it is advisable to review your policy regularly and make the necessary changes. For instance, if you purchase a new car or move to a new location, you might need to adjust your policy to match the new circumstances.

Finally, having car insurance coverage gives you peace of mind when driving. Driving can be stressful, especially when you are constantly worried about what would happen if you got into an accident. With car insurance coverage, you can relax, knowing that you are protected financially in case of an accident. You can drive with confidence, knowing that you are prepared for whatever eventualities might arise, and that you can handle them without incurring significant expenses.

Legal Consequences of Driving Without Insurance

Driving without insurance is not only risky but also illegal in almost every state in the US. Accidents can happen without warning and if you are found responsible for causing an accident, the costs of property damage, medical expenses, and lost wages can be enormous. In some cases, you may even be required to compensate all other people involved in the accident or even face legal suits.

The legal consequences of driving without insurance could be devastating and could impact your financial well-being. Here are some of the legal consequences of driving without insurance:

1. Financial Consequences

If you cause an accident and do not have insurance, you will be responsible for covering damages caused to the other party. The damages include medical costs, property damage, and lost wages. A single accident can cost you tens of thousands of dollars in these expenses, which could have a significant impact on your financial health.

If you cannot pay for damages, you could face legal action. The other party in the accident could file a lawsuit against you, and you could face a court order to pay the damages. If you cannot pay, the court may grant the other party the right to garnish your wages or take your assets to cover the costs.

2. Legal Penalties

Driving without insurance could result in legal penalties, which differ depending on the state you are in. If you are caught driving without insurance, you could face tickets, fines, or even imprisonment.

In most states, the penalty for driving without insurance is a fine. The fine could be anywhere from $500 to $1,000 or more. Additionally, your driver’s license and registration could be suspended until you can provide proof of insurance, and you may be required to present an SR-22 certificate for up to three years.

In some states, driving without insurance is a misdemeanor that could lead to imprisonment. This is particularly true if you have been caught multiple times driving without insurance or if you cause an accident that results in serious injuries or death. The penalties could be severe and could have lasting effects on your life.

3. Higher Insurance Rates

If you drive without insurance and are caught, you will be considered a high-risk driver by insurance companies. High-risk drivers are considered to be more likely to cause accidents, which means they will have higher insurance rates.

Even if you do not cause an accident, driving without insurance could impact your insurance rates. Insurance companies often check driving records to determine insurance premiums. If you have a record of driving without insurance, insurance companies could see this as a high-risk behavior and charge you higher rates as a result.

Driving without insurance could have serious legal consequences that could affect your finances and your life. It is always better to be safe than sorry and purchase insurance to protect yourself and others while driving on the road.

Steps to Take After a Car Accident Without Insurance

Car accidents can be painful, stressful, and expensive, especially when you don’t have adequate insurance coverage. It’s not only a legal requirement to have car insurance in many states, but it also helps to safeguard you and others on the road.

If you have no insurance, the car accident process becomes even more challenging. You’ll be responsible for paying for damages and may even be sued personally for any injuries or property damages you cause.

Here’s what to do if you’re involved in a car accident without insurance:

1. Report the Accident to Your Local Police Station

The first thing you should do after an accident is report it to your local police station. When you report the accident, the police officer will fill out an accident report. The report includes details of the accident, such as the date and time, location, description of the damage, and injuries sustained. The accident report is an official record that your insurance company and the court system may use when determining liability.

Providing a factual and accurate account of the accident is vital in this situation. The police officer will determine who’s at fault based on their investigation and evidence they collect, such as photos, interviews, and physical evidence.

2. Exchange Information With the Other Driver

After a car accident, you should exchange information with the other driver involved; getting their name, address, phone number, insurance policy information, driver’s license number, and license plate number. Providing your information, including your name, phone number, and possibly driver’s license number, is also essential.

Make sure you document everything, including taking photos of the accident scene and jotting notes about what happened. Photos can serve as evidence if you need to take legal action. Once you have exchanged information, it’s best to avoid discussing the accident with the other driver or take responsibility for the accident.

3. Contact a Car Accident Lawyer Without Insurance

If you don’t have insurance and were at fault in the accident, you might require the assistance of an experienced car accident lawyer without insurance. A car accident lawyer without insurance can provide legal advice and guidance on how to handle the legal process of the case.

The lawyer may help you in negotiating settlements and represent you in court proceedings if the matter ends up on a trial. They also know the ins and outs of the legal system and the loopholes applicable in such situations. Seeking legal advice and support in these circumstances could be the difference between being handed over legal and financial burdens or being able to be assisted in the situation.

Therefore, it is always wise to seek the services of a no insurance car accident attorney as the situation can be significantly expensive when doing it alone or with little legal knowledge and expertise.

4. Pay for Damages and Injuries Out of Pocket

If you caused an accident and don’t have car insurance, then you’ll have to pay for any damages and injuries sustained out of pocket. The damages may range from minor vehicle repairs to more extensive and costly ones, such as medical bills, not to mention the legal expenses. Therefore, it is wise to work out a payment plan with your attorney to avoid being caught off guard financially. The earlier you initiate the process, the smoother the process will be when it comes to payments.

It’s always critical to avoid driving without insurance when at all possible. Keeping up-to-date insurance coverage prevents you from potential legal and financial damage caused by an accident.

However, in the event that you find yourself at a car accident without insurance, the steps above will help you navigate through the process. Take the right precautions to minimize the legal and financial liabilities you may face due to your lack of insurance.

Hiring a Car Accident Lawyer to Protect Your Rights

Car accidents happen frequently, and if you’re involved in one, it’s essential to know your rights. Whether you’re at fault or not, having a car accident lawyer on your side can help protect your rights and ensure that you receive fair compensation.

When choosing a car accident lawyer, it’s crucial to choose one that specializes in car accident cases. They should also be familiar with the laws in your state concerning car accidents. A good car accident lawyer can help you understand your rights and responsibilities, as well as the legal options available to you.

Here are a few reasons why hiring a car accident lawyer is crucial if you’re involved in a car accident:

1. The lawyer can negotiate with the insurance company

Insurance companies are known for bending the law to have their way, and that’s why having a car accident lawyer can be very beneficial. A good lawyer can negotiate with the insurance company on behalf of their clients to reach a fair settlement.

Many insurance companies may offer a quick settlement, but it’s essential to have a lawyer review the terms of the settlement to ensure that your rights are protected. A lawyer can advise you on the merits of a settlement offer and help you negotiate a reasonable settlement.

2. The lawyer can help you receive fair compensation

If you’re involved in a serious car accident, you may be eligible to receive compensation for damages, medical bills, lost wages, and other expenses. A car accident lawyer can help you understand the types of compensation that may be available to you and advise you on the best course of action.

A good car accident lawyer can also help you recover compensation for pain and suffering caused by the accident. In some cases, the damages you suffer may be difficult to quantify, but a lawyer can help you navigate the legal process and receive the compensation you deserve.

3. The lawyer can help establish fault

Car accidents can involve multiple parties, and establishing fault can be challenging. A good car accident lawyer can help gather evidence and establish fault in the accident. They can also help you understand the implications of being at fault and advise you on the steps you need to take to protect your rights.

The lawyer can also help you identify all the parties responsible for the accident, including other drivers, car manufacturers, and even government entities if road conditions contributed to the accident.

4. The lawyer can help if you don’t have insurance

Driving without car insurance is illegal in most states, but accidents still happen. If you’re involved in a car accident and don’t have insurance, you may be worried about how to pay for the damages. A car accident lawyer can help you explore other options, such as filing a personal injury lawsuit against the other driver or pursuing damages through other means.

The lawyer can also help you better understand the consequences of driving without insurance and what steps you need to take going forward.

Ultimately, hiring a car accident lawyer can help you protect your rights, navigate the legal process, and receive fair compensation for damages. While no one wants to be involved in a car accident, having a good lawyer on your side can make all the difference.

Options for Compensation When You Don’t Have Insurance

Getting into a car accident without insurance can be a financial nightmare. In most states, driving without auto insurance is illegal and could result in hefty fines, license suspension or even jail time. However, if you get into an accident, you may not have insurance to cover damages or medical expenses. If you were not at fault, you may still be able to recover damages and compensation from the at-fault party. Here are some options to consider for compensation:

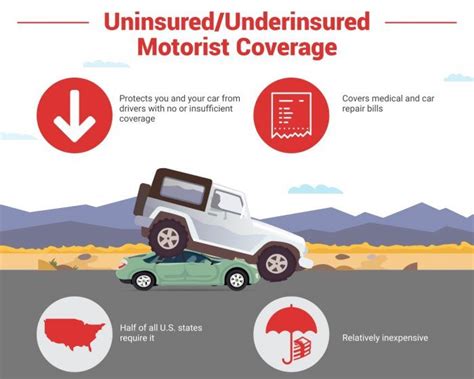

1. Uninsured Motorist Coverage

If you have uninsured motorist coverage, it may cover damages and injuries caused by an uninsured driver. This type of coverage is designed to protect you if you are involved in an accident with a driver who does not have insurance. Uninsured motorist coverage may also protect you in hit-and-run accidents, where the at-fault driver cannot be identified. However, uninsured motorist coverage is not required in all states, so it’s important to check your policy.

2. Personal Injury Protection (PIP)

Personal injury protection (PIP) is a type of coverage that pays for medical expenses and lost wages regardless of who is at fault in an accident. PIP coverage may also cover funeral expenses, rehabilitation, and other expenses related to the accident. In some states, PIP coverage is mandatory, while other states offer it as an option. If you have PIP coverage, it may help cover your medical expenses and missed work due to the accident.

3. Medical Payments Coverage

Medical payments coverage is an optional type of coverage that pays for medical expenses resulting from an accident, regardless of who is at fault. This type of coverage may also cover funeral expenses and dental expenses related to the accident. Medical payments coverage is generally less expensive than other types of coverage and may only cover a portion of the medical expenses.

4. Filing a Lawsuit

If you were not at fault in the accident, you may be able to file a lawsuit against the at-fault party to recover damages and compensation for your injuries. A car accident no insurance lawyer can help you file a lawsuit and represent you in court. The amount of compensation you may be entitled to will depend on the extent of your injuries, medical expenses, and lost wages. A car accident lawyer can help you navigate the legal system and ensure that you receive the compensation you deserve.

5. Negotiating With the At-Fault Party

If you were not at fault in the accident, you may be able to negotiate with the at-fault party to settle the claim out of court. Negotiating with the at-fault party can help you avoid court fees and decrease the amount of time it takes to settle the claim. You may be able to negotiate a settlement that covers your medical expenses, lost wages, and other damages resulting from the accident. However, it’s important to have a car accident lawyer review any settlement offers to ensure that you are receiving fair compensation.

Getting into a car accident without insurance can be stressful and overwhelming. However, there are options for compensation even if you don’t have insurance. By exploring your options and working with a car accident no insurance lawyer, you may be able to recover damages and compensation for your injuries and other expenses resulting from the accident.

telagainfo.com Informasi Bisnis dan Usaha

telagainfo.com Informasi Bisnis dan Usaha