Understanding Full Coverage Auto Insurance

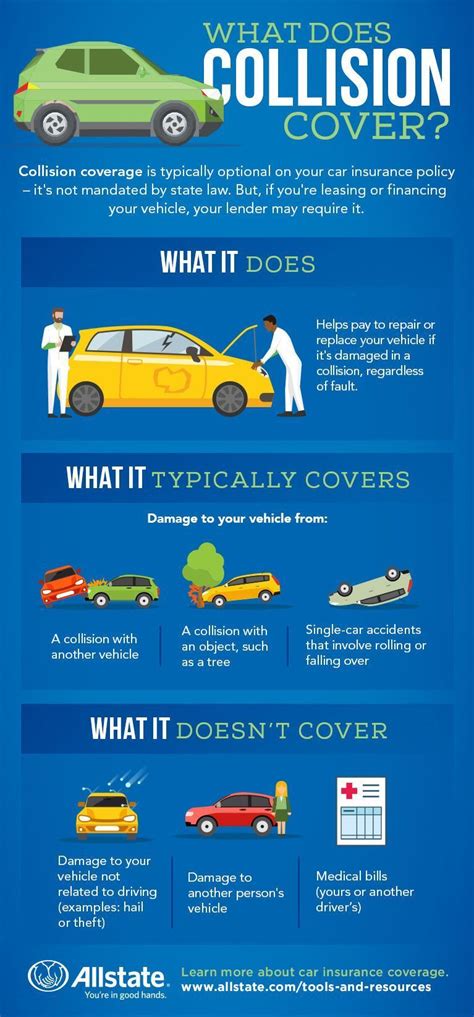

One of the most important things you need to know when shopping for cheap full coverage auto insurance in Illinois is what exactly “full coverage” means. Full coverage usually includes liability, collision, and comprehensive coverage. Liability coverage pays for damages or injuries you may cause to other people or their property in an accident. Collision coverage will pay for repairing or replacing your own car if it is damaged in an accident, regardless of who was at fault. Finally, comprehensive coverage will cover non-collision related damage to your car, such as theft.

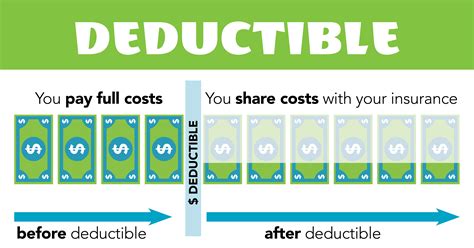

When you purchase full coverage auto insurance, you will typically have to choose your coverage limits and deductibles. A deductible is the amount of money you’ll have to pay out of pocket before your insurance kicks in. Higher deductibles can lower your monthly premiums, but will also mean you’ll have to pay more out of pocket if you get into an accident. Coverage limits refer to the maximum amount your insurance company will pay out for a claim. It’s important to choose coverage limits that will adequately protect you in case of an accident or other damage to your car.

Full coverage auto insurance can be more expensive than other types of insurance, but there are ways you can save money. One option is to bundle your auto insurance with your homeowner’s insurance or renter’s insurance. Many insurance companies offer discounts for multiple policies. You can also save money by choosing a higher deductible. Additionally, safe driving and keeping a clean driving record can help you qualify for discounts on your insurance premiums.

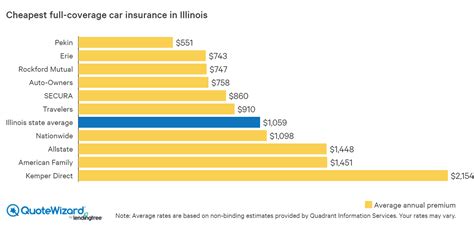

Before purchasing full coverage auto insurance, it’s important to do your research and compare insurance quotes from multiple companies. Cheap full coverage auto insurance in Illinois is available, but you’ll need to shop around to find the best rates and coverage for your needs. Don’t forget to read the fine print and carefully review your policy to make sure you understand what is and isn’t covered.

In conclusion, full coverage auto insurance can provide peace of mind and financial protection in case of an accident or other damage to your car. Understanding what full coverage includes and choosing your coverage limits and deductibles carefully can help you find affordable insurance that will adequately protect you and your vehicle.

Searching for Cheap Full Coverage Auto Insurance in Illinois

If you’re looking for cheap full coverage auto insurance in Illinois, there are several factors to consider. Full coverage insurance typically includes liability, collision and comprehensive insurance that covers most accidents, damages, and losses that occur on the road. Below are some tips that could potentially help you find affordable full coverage auto insurance in Illinois.

1. Shop Around and Compare Quotes

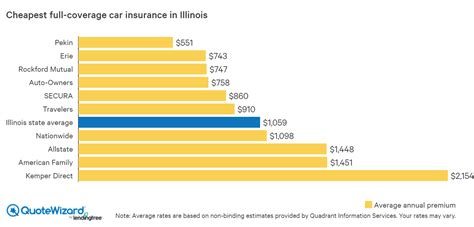

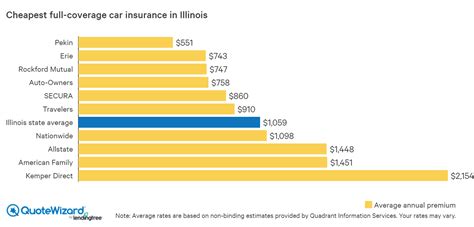

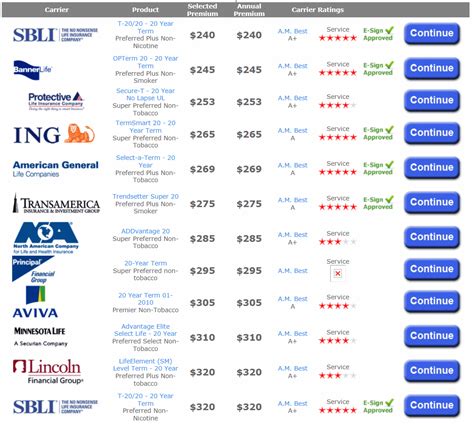

One of the most important ways to find cheap full coverage auto insurance is to shop around and compare quotes from various insurance companies. This will help you to understand the rates offered by different companies and choose the most cost-effective option that meets your needs. Be sure to compare the coverage provided by each policy, including specific details about liability, collision and comprehensive insurance. You can also check with your state’s Department of Insurance to find out which companies have the best rates for auto insurance in your area.

2. Maintain a Good Driving Record

Maintaining a good driving record is crucial in getting affordable auto insurance rates in Illinois. Many insurance companies charge higher rates for drivers who have a history of accidents or traffic violations. Make sure to drive safely, obey traffic laws, and avoid making claims as much as possible. Some insurance companies offer discounts for drivers who complete defensive driving courses or who have no records of accidents or traffic violations.

3. Increase your Deductible

Increasing your deductible can help to lower your monthly car insurance premium in Illinois. This means that you’ll pay more out-of-pocket if you’re involved in an accident, but it can save you money in the long run if you drive safely and avoid accidents. Be sure to choose a deductible amount that you can afford to pay upfront, in case of an accident.

4. Check for Discounts

Many insurance providers offer discounts for various reasons. For example, some companies offer discounts for good students, safe drivers, multi-car households, and military personnel. Additionally, some companies give discounts for bundling policies such as car, home, and life insurance. Make sure to check with your insurance provider to find out if you’re eligible for any discounts that can help reduce your car insurance costs in Illinois.

5. Consider the Type of Car You Drive

The type of car you own can also impact the cost of your auto insurance. Cars that are more expensive to repair or replace, or that have high theft rates, tend to have higher insurance rates. Consider purchasing a car that’s budget-friendly, reliable, and easy to maintain, in order to save money on your monthly insurance premiums.

In conclusion, there are several ways to find affordable full coverage auto insurance in Illinois. By shopping around and comparing quotes, maintaining a good driving record, increasing your deductible, checking for discounts, and considering the type of car you drive, you can potentially save money on your monthly car insurance premiums.

Factors that Affect Full Coverage Auto Insurance Rates in Illinois

When it comes to buying car insurance in Illinois, full coverage can be a smart choice. It includes liability, collision and comprehensive coverage, providing protection against various types of damage to your vehicle and potential liabilities that could arise in case of an accident. However, you might be wondering why the cost of full coverage auto insurance varies among drivers. Here are some factors that affect full coverage auto insurance rates in Illinois:

- Driving Record

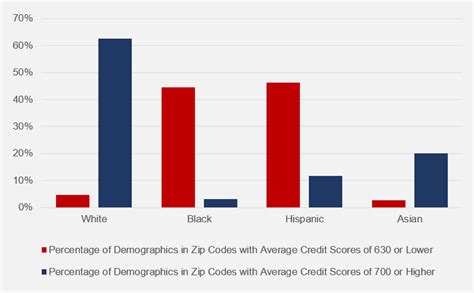

- Credit Score

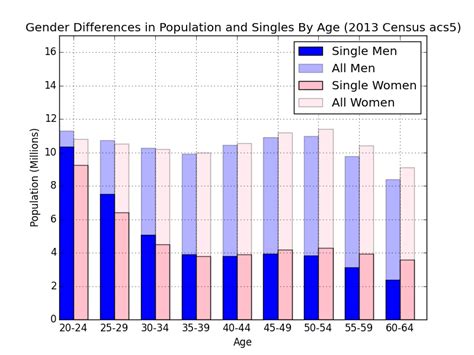

- Age and Gender

Your driving record can have a significant impact on your car insurance rates. If you have a history of speeding tickets, accidents or DUIs, your rates could be higher than someone with a clean driving record. Insurance companies see high-risk drivers as more likely to make claims in the future, so they charge them more for coverage.

On the other hand, if you have a spotless record, you could qualify for discounts and lower rates. Be sure to keep your driving record clean by following the rules of the road, and you could save money on car insurance in the long run.

Believe it or not, your credit score can influence your car insurance rates in Illinois. Insurance companies have found that people with lower credit scores are more likely to file claims, so they charge them higher rates to offset the potential risk.

To keep your car insurance rates low, it’s important to maintain a good credit score. Pay your bills on time, keep your credit card balances low and check your credit report regularly to make sure there are no errors that could be holding you back.

Younger drivers and men typically pay more for car insurance in Illinois than older drivers and women. This is because statistics show that younger drivers and men are more likely to get into accidents than their older and female counterparts.

If you’re a young driver or a man, there are still ways to save on car insurance. Consider taking a defensive driving course, maintaining good grades in school or installing safety features in your car. These actions could help lower your rates and make full coverage auto insurance more affordable.

By understanding the factors that affect full coverage auto insurance rates in Illinois, you can make informed decisions about your coverage and save money on car insurance. Be sure to compare quotes from multiple insurance companies to find the best rates, and don’t be afraid to ask about discounts and other ways to save.

Tips for Lowering Full Coverage Auto Insurance Costs in Illinois

There’s no denying that auto insurance can be a significant expense for drivers in Illinois. However, several tips can help you reduce your full coverage auto insurance costs in the state. These tips are not only effective but also legal, meaning you don’t have to take risks to save money on your insurance premiums.

Here are four subtopics to consider when lowering your full coverage auto insurance costs in Illinois:

1. Drive Safely:

One of the most effective ways to reduce your insurance premiums is by driving safely. Insurance companies use your driving history to determine your risk level and adjust your premiums accordingly. Therefore, if you have a history of accidents and traffic tickets, you’ll likely pay more for insurance coverage. However, if you avoid accidents and tickets, you’ll be considered a safer driver and qualify for lower insurance premiums.

In addition to lower insurance premiums, safe driving habits also reduce your risk of getting into an accident. This outcome not only saves you money on insurance but also helps you avoid medical bills, vehicle repairs, and other expenses associated with accidents.

2. Compare Insurance Quotes:

Another effective way to lower your auto insurance costs is by comparing insurance quotes from different providers. Insurance rates can vary significantly from one company to another, so it’s essential to shop around to find the best deal. When comparing quotes, ensure you’re comparing apples to apples, meaning you’re looking at the same coverage levels.

Keep in mind that the cheapest quote isn’t always the best option. Consider the reputation of the insurance company, their customer service, and the terms and conditions of the policy before making your decision.

3. Raise Your Deductible:

Increasing your deductible is another effective way to reduce your full coverage auto insurance costs in Illinois. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By raising your deductible, you’ll reduce your insurance premiums since you’re taking on more risk. However, ensure that you can afford the deductible in case of an accident. It’s recommended that you set aside the deductible amount in an emergency fund.

4. Take Advantage of Discounts:

Finally, take advantage of discounts offered by insurance providers to reduce your full coverage auto insurance costs in Illinois. Insurance companies offer discounts to safe drivers, good students, military personnel, and those with anti-theft devices in their vehicles. Additionally, purchasing multiple policies from the same insurance company can also qualify you for discounts.

When shopping for insurance, ensure you ask about available discounts and how you can qualify for them. Taking advantage of these discounts can save you hundreds of dollars on your premiums each year.

Conclusion:

Lowering your full coverage auto insurance costs in Illinois requires time, effort, and smart choices. By following the tips provided above, you can significantly reduce your insurance premiums while maintaining adequate coverage levels. Remember to drive safely, compare quotes, raise your deductible, and take advantage of available discounts.

Lastly, always read and understand the terms and conditions of your insurance policy before signing up. Ask questions if you’re unsure about anything and ensure that the policy meets your needs. With these tips, you’ll be on your way to affordable full coverage auto insurance in Illinois.

Benefits of Having Full Coverage Auto Insurance in Illinois

Driving in Illinois can be risky, which is why it’s important to have proper auto insurance. Full coverage auto insurance is a type of insurance that includes liability, collision, and comprehensive coverage. It is designed to cover damages that may result from accidents, theft, or other incidents that may occur while driving.

While full coverage auto insurance may seem like an expensive option, it can save you money in the long run. Here are the top benefits of having full coverage auto insurance in Illinois:

1. Protection from Liability Claims

Full coverage auto insurance includes liability coverage, which helps protect you if you are responsible for causing damage or injuries in a car accident. Liability coverage can help pay for the cost of repairs, medical expenses, lost wages, and other damages that may result from an accident.

2. Protection from Uninsured/Underinsured Motorists

Illinois is one of the states with the highest percentage of uninsured and underinsured drivers. If an uninsured or underinsured driver hits you, it can be difficult to recover any damages. However, having full coverage auto insurance can help protect you from this type of situation. It can provide you with the financial support you need to cover the damages and injuries caused by an uninsured or underinsured motorist.

3. Protection from Vehicle Theft

Full coverage auto insurance also includes comprehensive coverage, which can provide protection against vehicle theft. If your car is stolen or damaged in a non-collision incident, such as a natural disaster or vandalism, comprehensive coverage can help cover the cost of repairs or replacement.

4. Protection from Collision Damage

Collision coverage is another important part of full coverage auto insurance. It can help cover the cost of repairs if your car is damaged in a collision, regardless of who is at fault. This can be especially helpful if you are involved in a costly accident.

5. Peace of Mind

Having full coverage auto insurance can give you peace of mind while you’re on the road. You can rest easy knowing that you and your vehicle are protected against a wide range of risks. Instead of worrying about what might happen, you can focus on enjoying the ride.

Overall, full coverage auto insurance is a smart investment for Illinois drivers. It can provide you with the protection and peace of mind you need to feel confident on the road. Don’t let the cost of insurance deter you from getting the coverage you need. With a little research and shopping around, you can find affordable full coverage auto insurance that fits your budget.

telagainfo.com Informasi Bisnis dan Usaha

telagainfo.com Informasi Bisnis dan Usaha