Understanding California Small Business Health Insurance Requirements

If you own a small business in California, you are required by law to provide health insurance to your employees. California is one of the few states in the US that requires small business owners to offer health insurance to their employees, regardless of the size of the business. The goal of this requirement is to ensure that all employees, whether they work for a large corporation or a small business, have access to quality healthcare that is affordable and accessible.

As a small business owner in California, there are several things you need to know about the state’s health insurance requirements. Firstly, you must provide health insurance if you have one or more employees, even if they only work part-time. Secondly, you must offer health insurance to all employees who work 30 or more hours per week. Finally, you must pay at least 50% of the premium cost for your employees’ health insurance.

The type of health insurance you offer your employees must also meet certain government standards, such as offering a minimum standard of coverage, including preventive care, maternity care, and coverage for pre-existing conditions. The insurance policy must also meet certain affordability requirements, which means that the premium cost must not exceed a certain percentage of the employee’s income.

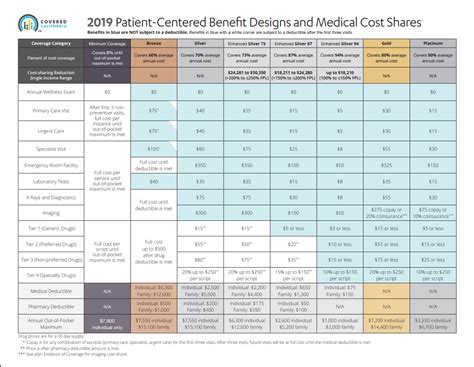

The California Health Benefit Exchange, also known as Covered California, offers small business owners the opportunity to purchase health insurance for their employees. Covered California is a health insurance marketplace that offers a range of policies from different insurance providers. Small business owners can choose from a variety of plans that meet the state’s requirements and can use Covered California’s online tools to compare and purchase policies.

Another option available to small business owners is to purchase insurance policies directly from insurance providers. This option provides more flexibility in terms of the types of policies available, but may be more expensive than purchasing policies through Covered California.

Finally, small business owners can also choose to partner with other businesses in their industry to create a purchasing group. By joining together, businesses can negotiate lower rates for health insurance policies, giving them access to quality health insurance at a more affordable price.

In conclusion, small business owners in California have a legal obligation to provide health insurance to their employees. This requirement is aimed at ensuring that all employees have access to quality healthcare that is affordable and accessible. Small business owners have several options available to them when it comes to purchasing health insurance policies for their employees, including using Covered California, purchasing policies directly from insurance providers, or partnering with other businesses to form a purchasing group.

Options for California Small Business Health Insurance Providers

Choosing the right health insurance provider for your small business in California can be daunting, but it’s a critical decision that can make a big difference in the wellbeing of your employees and overall success of your business. Here are some of the most popular options for California small business health insurance providers.

1. Covered California for Small Business

Covered California for Small Business is a state-run health insurance marketplace designed for small businesses with one to 100 employees. It offers a variety of health insurance plans from major insurance companies like Blue Shield, Kaiser Permanente, and Health Net. Covered California offers flexibility for employers to choose how much they want to contribute to their employees’ premiums, and employees can choose the plan that best suits their needs. Covered California also provides tax credits to eligible small businesses, which can help reduce their health insurance costs.

2. Private Health Insurance Companies

Private health insurance companies like Blue Shield, Cigna, and Aetna offer a variety of health insurance plans for small businesses in California. These plans can be customized to meet the specific needs of your business and employees. Private health insurance plans often offer more provider options than Covered California plans, but may be more expensive. Employers may also have more control over their premium contributions with private health insurance companies.

3. Health Maintenance Organizations (HMOs)

HMOs are health insurance plans that provide coverage only if you use doctors and hospitals that are within the HMO’s network. HMOs can be a good option for small businesses on a budget because they typically cost less than other plans. However, employees may have limited provider options and may need to get referrals to see specialists. Popular HMOs include Kaiser Permanente and Health Net.

4. Preferred Provider Organizations (PPOs)

PPOs are health insurance plans that offer more flexibility in terms of provider options. Employees can choose to see providers within the PPO’s network or outside of the network, although out-of-network costs may be higher. PPOs tend to be more expensive than HMOs, but may be a good option for businesses with employees who need more flexibility in choosing their healthcare providers. Popular PPOs include Blue Shield and United Healthcare.

5. Point of Service (POS) Plans

POS plans are a combination of HMO and PPO plans. With a POS plan, employees choose a primary care physician within the plan’s network and can be referred to specialists outside of the network. POS plans tend to be more expensive than HMO plans, but less expensive than PPO plans. POS plans may be a good option for small businesses that want a balance between flexibility and affordability. Popular POS plans include Aetna and Cigna.

Ultimately, choosing the right health insurance provider for your small business in California will depend on your budget, employee needs, and preferences. Consider working with a licensed insurance broker who can guide you through the process of choosing a plan that meets your unique needs.

The Pros and Cons of Self-Funded Small Business Health Insurance

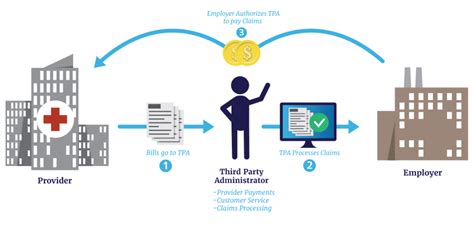

As a small business owner, it’s important to ensure that you have adequate health insurance coverage for your employees. It’s no secret that healthcare costs in California can be high, and oftentimes businesses struggle to keep up with these costs. One option that small business owners have is to self-fund their health insurance plans. This can be a great option, but it does come with its own set of pros and cons.

The Pros

There are several benefits of self-funding your small business health insurance plan:

- Cost Savings: One of the most significant advantages of self-funding your health insurance plan is that it can save you money in the long run. This is because you only pay for the healthcare costs of your employees rather than paying a fixed fee to an insurance company. When you self-fund, you can adjust your coverage to meet the specific needs of your employees, which can help to lower overall costs.

- Customization: When you self-fund your health insurance plan, you have more control over the benefits you offer your employees. This means that you can tailor your plan to meet the specific needs of your employees and provide the coverage they need most. This can be a great way to attract and retain talented employees.

- Transparency: When you self-fund your health insurance plan, you know exactly where your money is going. This is because you have access to detailed reports and information about your employees’ healthcare costs. This can help you to make more informed decisions about your coverage moving forward.

- Tax Benefits: Self-funded health insurance plans often come with tax benefits. For example, you can deduct the cost of healthcare expenses from your business’ taxable income. Additionally, when your employees cover their portion of their healthcare costs, those funds are not taxed as income.

The Cons

There are some disadvantages to self-funding your small business health insurance plan:

- Financial Risk: When you self-fund your health insurance plan, you take on more financial risk. This is because you are responsible for covering all healthcare costs for your employees, regardless of how much they may be. If you have a major healthcare expense, it can be difficult to cover the cost and maintain your business operations.

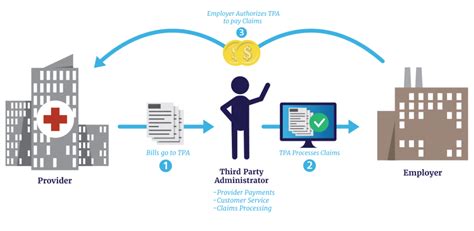

- Administrative Burden: Self-funding your health insurance plan can require more administrative work. This is because you are responsible for managing your coverage, paying healthcare bills, and coordinating with healthcare providers. It’s important to have a dedicated team in place to handle these tasks.

- Less Predictable Costs: One of the biggest challenges of self-funding your health insurance plan is that costs can be less predictable. Unexpected medical expenses can arise and this can lead to higher costs than you might have anticipated. It’s important to have a strong financial plan in place to manage these expenses if they do occur.

Overall, self-funding your small business health insurance plan can be a great option for many business owners. It offers cost savings, customization, and transparency, which are all important factors in ensuring that your employees have the coverage they need. However, it’s important to be aware of the potential risks and drawbacks involved as well so that you can make an informed decision about whether self-funding is right for you and your business.

Comparing Group Health Insurance Plans for California Small Businesses

Health insurance is a crucial benefit for small business owners in California. Providing health insurance to employees shows your commitment to their wellbeing and also helps attract and retain top talent. However, choosing the right group health insurance plan can be a daunting task. Here are some factors to consider when comparing group health insurance plans for small businesses in California:

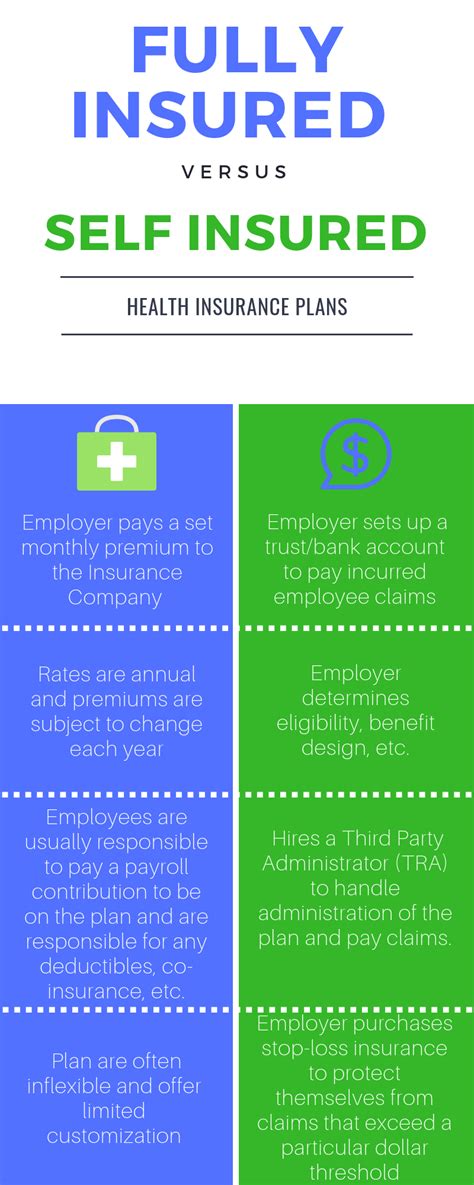

1. Cost of Premiums

The cost of premiums is one of the most important considerations when comparing group health insurance plans. With group plans, the cost of premiums is shared between the employer and employees. Employers typically pay a percentage of the premium, while the employees pay the rest. It is essential to find a plan with affordable premiums, as high premiums can be a burden for both the employer and employees. When comparing plans, make sure to look at the premium costs for the different coverage options offered.

2. Coverage and Benefits

Another crucial factor to consider when comparing group health insurance plans is the coverage and benefits offered. The coverage and benefits of a plan can vary significantly, so it’s essential to carefully review the details of each plan. Some plans may have lower premiums but offer less coverage, while others may have higher premiums but offer more comprehensive coverage and benefits. It is also essential to consider the specific needs of your employees when choosing a plan. For example, if your employees require regular prescription medications, you will want to find a plan that offers good prescription coverage.

3. Network of Doctors and Hospitals

The network of doctors and hospitals available under a health insurance plan is also an important consideration. Most plans have a provider network of doctors and hospitals that are part of the plan’s preferred provider organization (PPO) or health maintenance organization (HMO). The PPO plans offer more flexibility to visit any doctor or hospital, while HMOs require that you choose a primary care physician and get referrals for any specialists. When comparing plans, make sure to check that your preferred doctors and hospitals are part of the provider network.

4. Customer Service and Support

The level of customer service and support offered by an insurance provider is also crucial. Small business owners need reliable customer service to navigate the complexities of health insurance plans. When comparing plans, check for customer reviews of the insurance provider’s customer service. You want a provider that is responsive, helpful, and easy to work with. It is also essential to find a provider that offers online portals or mobile apps to make it easy for employees to access information and manage their benefits.

Conclusion

When it comes to comparing group health insurance plans for small businesses in California, there are many factors to consider. The cost of premiums, coverage and benefits, network of doctors and hospitals, and customer service and support are all important considerations that can impact the overall quality of the plan. By carefully reviewing each plan’s details and considering your employees’ specific needs, you can find the right group health insurance plan that provides the best value for your small business.

Navigating the California Health Insurance Marketplace for Small Businesses

As a small business owner, finding the right health insurance can be a challenging and confusing process. With the implementation of the Affordable Care Act, small business owners in California have the option to purchase health insurance through the Small Business Health Options Program (SHOP) Marketplace, which was created specifically for businesses with 50 or fewer full-time equivalent employees. However, understanding how to navigate the California Health Insurance Marketplace can feel overwhelming. Here are five tips to help small business owners through the process.

Tip 1: Understand Your Business’s Health Insurance Needs

Before beginning the process of purchasing health insurance through the California Health Insurance Marketplace, it is essential to determine your business’s health insurance needs. Consider factors such as the number of employees, desired coverage, budget, and preferred network of healthcare providers. Understanding your business’s specific needs will simplify the process of selecting a policy that aligns with your requirements.

Tip 2: Go Through the Eligibility Criteria

Before you can sign up for a group health plan through the California Health Insurance Marketplace, you will need to review the eligibility criteria provided by the program. Make sure you meet its requirements before submitting your application. Eligibility is based on factors such as the size of your business, whether your employees are full-time or part-time, and whether you contribute towards your employees’ premiums.

Tip 3: Compare Different Health Insurance Plans

The California Health Insurance Marketplace offers various health insurance plans from different insurers to choose from. It is critical to compare and contrast different policy options to find the one that best meets your business’s needs. Consider factors such as coverage, network of healthcare providers, premiums, copayments, and deductibles when making your selection. The SHOP Marketplace offers a detailed comparison tool that makes it easy to compare plans side-by-side.

Tip 4: Seek Help When Navigating the Marketplace

The California Health Insurance Marketplace can be overwhelming for small business owners, especially for those who are new to the healthcare industry. To help navigate the process, business owners should leverage the resources available to them, such as certified insurance agents and brokers, who can provide expert guidance and advice.

Tip 5: Stay on Top of Changes to Health Insurance Laws and Regulations

The healthcare industry is continually evolving, with changes to health insurance laws and regulations that could impact your business’s coverage options. Small business owners should stay informed and up-to-date with the latest developments to make informed decisions about their employees’ health insurance coverage. Being proactive and staying informed can help businesses mitigate any potential risks and take advantage of new opportunities.

In conclusion, navigating the California Health Insurance Marketplace can be an intimidating process for small business owners. However, following these five tips can make the process simpler, and ultimately lead to finding the right health insurance policy for your business’s needs.

telagainfo.com Informasi Bisnis dan Usaha

telagainfo.com Informasi Bisnis dan Usaha