Understanding NY Insurance Lapse

Have you ever received a notice from the Department of Motor Vehicles (DMV) stating that you have an insurance lapse? This might be a confusing and frustrating experience, but let’s break it down to help you understand what it means and what you can do about it.

The state of New York requires all drivers to have minimum liability insurance to legally operate a vehicle. If you fail to maintain insurance coverage or do not provide proof of insurance to the DMV when requested, your insurance coverage will be considered lapsed, and the DMV will take action against your driving privileges.

When your insurance lapses, your insurer will inform the DMV, and they will send you a notice of termination. This notice will state that you have to submit proof of new insurance to the DMV within a specified timeframe. If you do not provide proof of insurance within that timeframe, the DMV will suspend your vehicle registration and your driver’s license, making it illegal for you to operate a car in the state of New York.

During a lapse, you are also at risk of being penalized with fines and other fees. If you continue to drive with an insurance lapse, you will be breaking the law, and if you are caught, you could face legal trouble, including tickets, fines, and possibly even jail time.

It’s important to note that just because a lapse occurred, it doesn’t mean you can’t get your vehicle registration and driver’s license reinstated. Firstly, you must purchase a new insurance policy and provide proof of coverage to the DMV within the specified timeframe.

Once you have proof of coverage, you can request the DMV to reinstate your driver’s license and vehicle registration. However, note that you may also have to pay an additional fee to have your license and registration reinstated.

It’s useful to keep in mind that insurance lapses can happen to anyone, even the most careful drivers. To avoid lapses, make sure to always keep your insurance policy updated and provide proof of coverage promptly when requested by the DMV.

If you are facing an insurance lapse, do not panic, as it can be corrected. Take steps to reinstate your coverage to get back on the road as soon as possible. In the end, it’s always better to have insurance coverage and avoid the headaches of lapses and legal issues altogether.

Consequences of Driving Without Insurance in DMV NY

Driving without insurance is a serious offense in the state of New York. In fact, it is illegal to operate a vehicle without insurance coverage or proof of financial responsibility. People often choose to drive without insurance coverage as they believe it to be an unnecessary expense, especially if they have never been involved in a car accident before. However, driving without insurance can have severe consequences that can impact the driver for years to come.

Consequences of Driving Without Insurance in DMV NY

One of the most serious consequences of driving without insurance in DMV NY is a fine of up to $1,500 for a first offense. Repeat offenders may face higher fines, as well as the possibility of having their license suspended. The driver may also find it much harder to get auto insurance in the future, and the premiums may be much higher, making it even more difficult to set up a budget for a driver who has a limited income.

Consequences of Driving Without Insurance in DMV NY

Another severe consequence of driving without insurance in DMV NY is the financial burden placed on a driver in the event of a car accident. If a driver is involved in a car accident, the victim has the right to sue for damages, which can include medical bills, lost wages, and pain and suffering. If the driver who caused the accident is uninsured, they may be responsible for paying these damages out of their own pocket.

With the ever-rising costs of medical bills and car repair, the financial responsibility could run into millions of dollars. Thus, it is essential for drivers to have insurance coverage to avoid creating a massive financial burden in the event of an accident.

Consequences of Driving Without Insurance in DMV NY

Driving without insurance and getting into an accident can also have long-term consequences. If the driver needs to borrow money for a car or home loan later in life, the lender will look at their driving history. Any driver with a history of accidents and lack of insurance coverage may automatically be disqualified for obtaining loans. Hence, even if one eventually intends to buy a car or a home, driving without insurance in the past may prevent getting these loans and disadvantage the driver from having other life opportunities that require a significant amount of money.

Driving without insurance coverage is a mistake that can lead to significant consequences in DMV NY. It is critical for drivers to avoid such a situation by always ensuring that they have adequate insurance coverage. Besides, drivers should make it a habit to carry their proof of insurance with them on the road, as they may face penalties if they cannot provide proof of insurance when requested by a police officer.

Steps to Reinstate Your NY Insurance Policy After a Lapse

If you have experienced a lapse in your car insurance coverage in New York, it is important to take immediate action to reinstate your policy and avoid facing penalties or legal consequences. Here are the steps you need to follow:

1. Determine the Reason for the Lapse

Before you can address your insurance lapse, you need to identify the reason why it happened. Common causes of an insurance lapse include non-payment of premiums, expiration of the policy, or a cancellation due to a violation of the terms of the policy. Knowing the cause of your lapse will help you take the necessary steps to reinstate your policy in a timely and effective manner.

2. Contact Your Insurance Company

Once you have identified the reason for your insurance lapse, you need to contact your insurance company to discuss the situation and explore your options for resolving it. Your insurer may be able to offer you a reinstatement option that allows you to resume your coverage without any gaps or penalties. Alternatively, they may advise you to reapply for a new policy at a higher premium rate due to the lapse in your coverage.

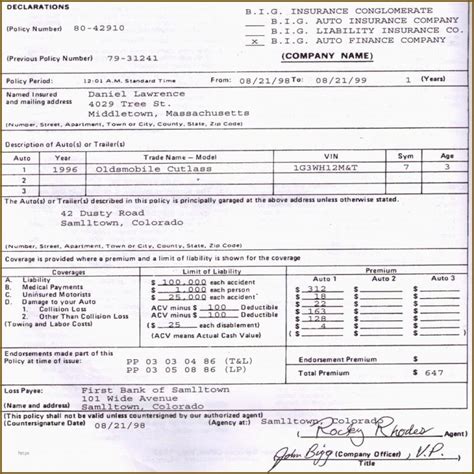

3. Provide Proof of Insurance and Pay Any Fees

In order to reinstate your policy, you will need to provide your insurance company with proof of insurance, such as a new policy number or a letter from your previous insurer. You may also need to pay any fees or premiums that were due during the lapse period, as well as any reinstatement fees that your insurance company may charge. Make sure to get written confirmation from your insurer that your policy has been reinstated and that you are fully covered.

Reinstating your car insurance after a lapse requires prompt action and careful attention to detail. By following these steps and working closely with your insurance company, you can avoid costly penalties and ensure that you have the coverage you need to stay safe on the road.

How to Avoid Future Insurance Lapses in DMV NY

If you’ve experienced an insurance lapse in DMV NY, you understand how inconvenient and costly it can be. An insurance lapse occurs when you go without auto insurance coverage for any period of time. It can result in fines, loss of your driver’s license, and a substantial increase in your insurance rates. That’s why it’s important to take steps to avoid future insurance lapses. Below are some tips to help you not only avoid a lapse but also keep your insurance rates low:

1. Pay Your Premiums on Time

One of the most common reasons for an insurance lapse is failure to pay premiums on time. Make sure you know when your payment is due and mark it on your calendar. Consider setting up automatic payments, so you don’t have to remember to pay your bill each month. If you’re struggling to pay your premiums, talk to your insurance company about payment plans or other options that may be available.

2. Understand Your Coverage

It’s essential to understand your insurance coverage, including what is and isn’t covered, how much insurance you need, and any optional coverages you can add. Make sure you know your deductible, which is the amount you have to pay out of pocket before your insurance kicks in. Choosing higher deductibles can lower your premiums, but it also means you’ll have to pay more if you’re in an accident.

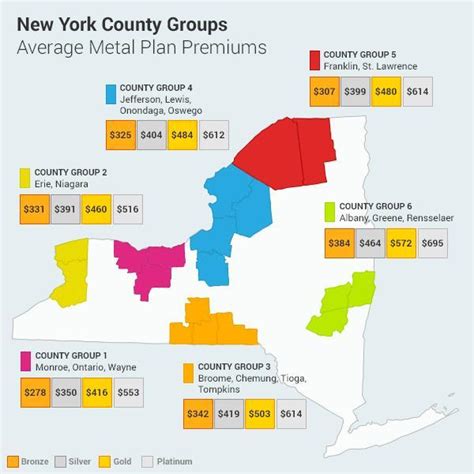

3. Shop Around for Rates

Don’t assume that your current insurance company is offering you the best rates. It’s a good idea to shop around and get quotes from a few different companies. Compare the coverage and rates to see which company offers you the best value for your money. You can also talk to an insurance agent, who can help you navigate the insurance market and find the right coverage for your needs.

4. Drive Safely and Responsibly

Another reason for an insurance lapse is a history of accidents or other driving violations. It’s essential to drive safely and responsibly to avoid accidents and tickets. Follow speed limits, wear your seatbelt, and avoid distractions like using your phone while driving. Keep your car in good condition with regular maintenance, including checking your brakes, tires, and lights. Safe driving not only helps you avoid insurance lapses but can also keep your premiums low.

By following these tips, you can avoid future insurance lapses in DMV NY and keep your insurance rates low. Remember to pay your premiums on time, understand your coverage, shop around for rates, and drive safely and responsibly. With a little effort and attention to detail, you can ensure that you have the insurance coverage you need when you need it.

Importance of Maintaining Continuous Auto Insurance in NY

As a driver in New York, it’s crucial to understand the importance of maintaining continuous auto insurance coverage. Not only is it required by the law, but it also protects you and other drivers on the road. Driving without auto insurance in NY can lead to severe consequences, including fines, license suspension, and even vehicle impoundment.

The Consequences of an Insurance Lapse in NY

An insurance lapse occurs when you allow your auto insurance policy to expire or cancel without replacing it immediately. If you are caught driving during this period, you will be considered an uninsured driver in the eyes of the law. In New York, the penalties for driving without insurance are steep.

Firstly, if you are caught driving without car insurance in NY, you could be fined up to $1,500 for a first offense. This fee can increase to $5,000 for a second offense. Along with these fines, your driver’s license will be suspended for at least one year. And if you’re caught driving with a suspended license, things can get even worse.

Additionally, if you get into an accident while uninsured, you will be personally responsible for all damages and injuries incurred. This is a scary thought, as an accident can easily cost thousands of dollars or more in medical bills and property damages. Without insurance, you’ll need to pay these fees out of pocket, which can be devastating financially.

Summary

Maintaining continuous auto insurance coverage is essential for any driver in NY. It’s not only required by the law, but it also provides financial protection for you and others in the event of an accident. Make sure to keep your policy up to date and pay your premiums on time to avoid any lapses in coverage. It’s a small price to pay for the peace of mind that comes with knowing you and your vehicle are protected while on the road.

telagainfo.com Informasi Bisnis dan Usaha

telagainfo.com Informasi Bisnis dan Usaha